The Audit Specialists for Unregulated Business Loans

Over the last decade, the UK has seen the rapid growth of alternative business financing. Although FCA regulation protects consumers when they borrow, many commercial lenders are unregulated.

This means that anyone can become a commercial lender with minimal checks.

Business Owners are Paying the Price…

You may be completely unaware of the lack of checks to ensure that the correct amount of interest is being charged.

Terms & Conditions for a loan or mortgage are often unclear, and manually checking they have been adhered to can be challenging.

As a result, your business could have paid more interest than it should have. You may be due a refund!

The Problem is Compounded

An error that results in an overcharge of interest may seem small in the short-term. Loans and mortgages are repaid over many years. The interest overcharge is compounded.

This means that any mistakes in interest charges can result in a claim valued at many times more than the original error.

A free audit is the first step to reclaiming the value of any mistakes your lender has made. That’s money you can use to reduce the balance of a loan or mortgage, for instance. You could alternatively put that money back into your business.

What We Do

Secured Lending Audit work on your behalf to investigate your loan or mortgage documents. This must be on a live loan or mortgage, or a loan or mortgage which has been paid off in the last six years. If we discover any mismanagement, we report back to you with the amount that could potentially be reclaimed.

Then we go to work to reclaim the current value of the error.

If no errors are found, our service is completely free.

Our Process

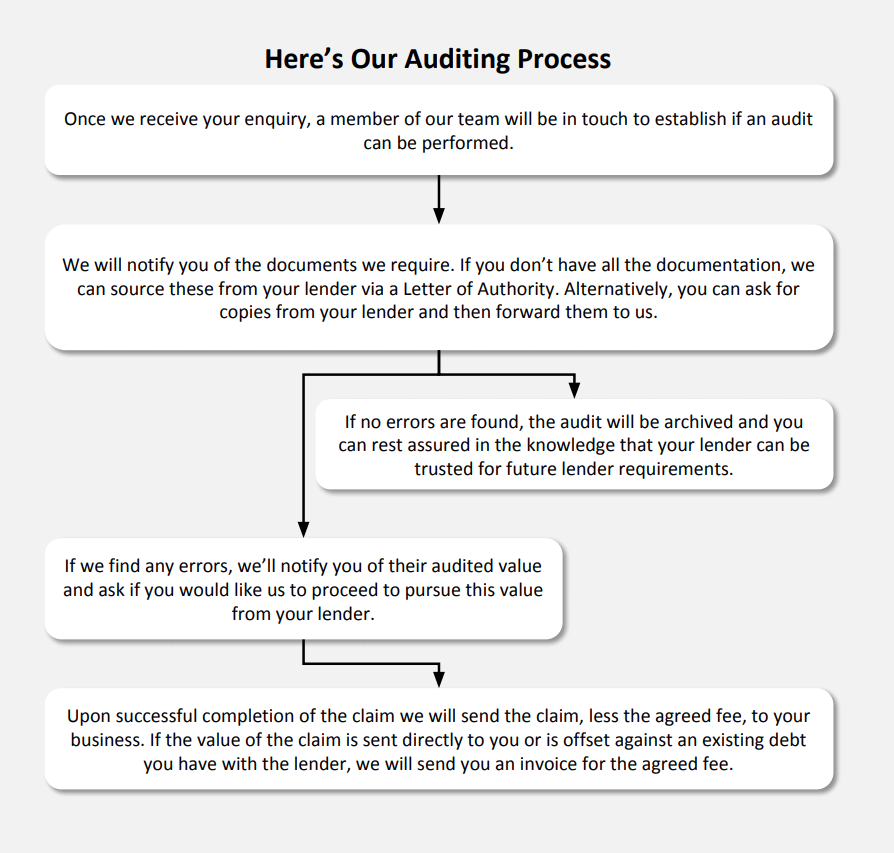

Here’s Our Auditing Process 1: Once we receive your enquiry, a member of our team will be in touch to establish if an audit can be performed. 2: We will notify you of the documents we require. If you don’t have all the documentation, we can source these from your lender via a Letter of Authority. Alternatively, you can ask for copies from your lender and then forward them to us. 3: If no errors are found, the audit will be archived and you can rest assured in the knowledge that your lender can be trusted for future lender requirements. 4: If we find any errors, we’ll notify you of their audited value and ask if you would like us to proceed to pursue this value from your lender. Upon successful completion of the claim we will send the claim, less the agreed fee, to your business. If the value of the claim is sent directly to you or is offset against an existing debt you have with the lender, we will send you an invoice for the agreed fee.

Want to know more? Contact a member of our team now to discuss your loan and find out how we work.

Zero Risk, Just Reward

Due to the nature of our business model, if you an audit establishes your lender has properly managed your loan or mortgage then you won’t have to pay a thing for our auditing service. Our fee only becomes due upon a successful completion of a claim.

If we find any errors, you could receive a substantial payout. And if we don’t, you can rest easy knowing that your lender is managing your loan or mortgage correctly and continue working with them in complete confidence.